This is Part 1 of an ongoing blog series that examines how renewable energy investment policy is changing to address inequity.

As climate change impacts intensify, energy policies continue to strengthen, but so far, the energy transition has been less than equitable. The World Resources Institute observed in 2021 that “existing and longstanding social and economic inequities result in climate change disproportionally endangering those who are least responsible for it.”[1]

The same is true for climate solutions. New technologies tend to benefit those who can best access and afford them. Rooftop solar is more accessible to single-family homeowners with good credit and time to investigate their options. Meanwhile, the impacts of proposed solutions may fall disproportionately on communities of color, low-income, and frontline communities.

Increased recognition of the need for equity in climate policy (both for the impacts and the solutions) is resulting in a greater emphasis on the direction of renewable energy investments towards low-income and disadvantaged communities.

Inflation Reduction Act Benefits for Low-Income Communities

With the first anniversary of the passage of the Inflation Reduction Act (IRA) now behind us, the funding directed to the clean energy sector is being felt. In the first year since its passage, over $270 billion was invested in clean energy projects and manufacturing facilities, according to the American Clean Power Association.[2] Corporate funding for the solar sector in the first half of 2023 totaled $18.5 billion, compared with the $12 billion invested in the first half of 2022, according to a July report from Mercom Capital Group.[3]

Distributed solar investments ( for projects under 5 megawatts AC) from the IRA are dispersed through the investment tax credit (ITC) program, which has been a critical incentive for distributed solar since the Energy Policy Act of 2005. In the years since its initial passage, the ITC was renewed periodically with short terms, often threatening to sunset unless there was action taken by Congress at the eleventh hour, putting the solar industry in a recurring cycle of late-year scrambling to pencil projects. Now, at long last, the ITC (and its future version to be renamed the Clean Electricity Investment Tax Credit), will remain in place through 2032 – possibly longer.

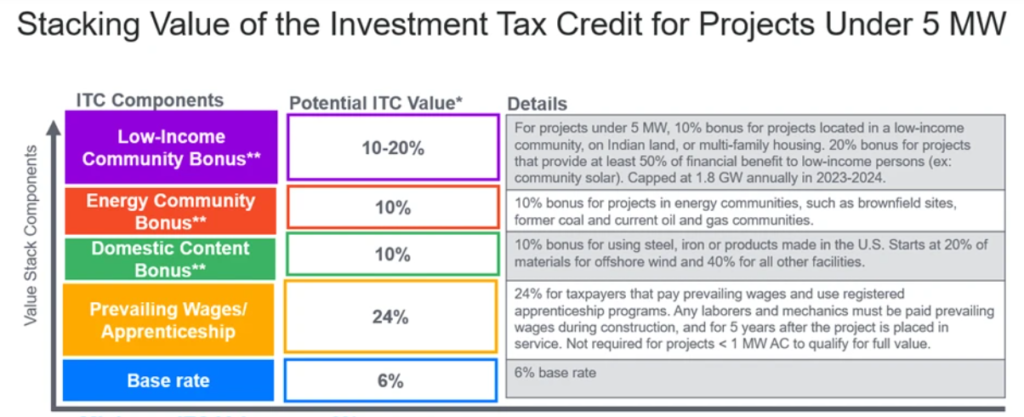

The new ITC has multiple layers of bonus credit for a variety of criteria.

Figure 1 – Source: https://www.edisonenergy.com/blog/ira-tax-provisions-prove-promising-for-the-renewables-sector/

- The base incentive of 6% is increased to a 30% tax credit for projects over one megawatt that meet the Prevailing Wage and Apprenticeship rules (projects under one megawatt are exempt from the wage and apprenticeship requirements and get the 30% base credit automatically).

- Another 10% bonus credit is available if Domestic Content is used, which means the components are produced by domestic manufacturers using domestic materials.[4] The requirements for Domestic Content are based largely on the existing Buy America Requirements in sections 661.1 through 661.21 of title 49 of the Code of Federal Regulations, and include three key parts: 1) the Steel or Iron Requirement, 2) the Manufactured Products Requirement, and 3) a requirement to submit a certification statement.

- The Energy Community bonus offers a 10% bonus credit for projects sited in energy communities such as brownfields, or sites affected by oil, gas or coal operations.

- The Low-Income Communities Bonus Credit Program—also known as Section 48(e)— offers four categories of bonus credit (either 10% or 20%) that provides new access to clean energy tax credits aimed at disadvantaged populations and communities with environmental justice concerns.

Each of these bonus credits are stackable, which means that adding the full allocation of energy community and low-income community bonus credits to domestic content and prevailing could stack up to 70% tax credit if a project qualifies for all bonus credits.

ITC Low-Income Communities Bonus in Detail

A total of 1.8 gigawatts (GW) of DC capacity will be allocated across the four categories of the Low-Income Communities bonus for each of the calendar year 2023 and 2024 programs as follows:

| Category 1: Located in a Low-Income Community | 700 megawatts | 10% bonus adder |

| Category 2: Located on Indian land | 200 megawatts | 10% bonus adder |

| Category 3: Qualified Low-Income Residential Building Project | 200 megawatts | 20% bonus adder |

| Category 4: Qualified Low-Income Economic Benefit Project | 700 megawatts | 20% bonus adder |

Source: IRS, Treasury Guidance, Final Regulations. [5]

Category 1 is for projects physically located within a low-income community (see useful links below for a mapping tool by NREL), but the energy does not have to be allocated to low-income households.

Community Solar projects for low-income communities fall under Category 4, which is applicable to projects where at least 50% of the financial benefits will be provided to low-income qualified[6] households (meaning households with incomes below 200% of the poverty line or below 80% of the area median gross income), and the project must offer all low-income subscribers a 20% bill credit discount rate. Behind the meter projects do not qualify for the Low-Income Communities bonus credit.

A project does not need to have subscribers enrolled to apply for the bonus, but once it is placed in service the project must demonstrate that the requirements are satisfied for the award allocation to be formally claimed.

Understanding these federal programs is necessary for projects to fully leverage all possible incentives and do so in a way that prioritizes the paying forward of benefits to customers who are least able to access them. This important policy objective is a step towards a more equitable climate transition.

Useful Links:

The US Department of Energy website on the Low-Income Communities Bonus Credit program is here: https://www.energy.gov/diversity/low-income-communities-bonus-credit-program

Treasury final regulations (new Section 48(e) of the Code): https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3A1a431951-6e9d-363f-ae56-60c2123fb4eb

Instructions for submitting the application are detailed in Rev. Proc. 2023- 27: https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3A17244411-2ee0-3e0f-912a-35c2e4cc6d95

A map by DOE and NREL for identifying Category 1 eligibility and the Additional Selection Criteria is available here: https://experience.arcgis.com/experience/12227d891a4d471497ac13f60fffd822/page/Page/

Please stay tuned for Part 2 of this series, which will dig deeper into New York State’s low-income solar incentives. Future topics will also include an examination of who qualifies as low-income and what methods of verification are required; how will the Federal ITC and NY State incentive stack together; how municipalities and other entities with low or no tax liability utilize the Direct Pay or Transfer programs to monetize tax credits; what project costs are included in the ITC and more…

If you have topics to suggest or want to learn about, please email me at dana@danahallfirm.com.

[1] The US Clean Energy Transition Isn’t Equitable — But it Could Be. By Carla Walker, 11/29/2021. https://www.wri.org/insights/achieving-equitable-us-clean-energy-transition

[2] American Clean Power Association (August 2023) https://cleanpower.org/wp-content/uploads/2023/08/ACP_InvestinginAmerica_Report_website.pdf

[3] https://mercomcapital.com/product/1h-q2-2023-solar-funding-ma-report/

[4] Domestic Content Bonus Credit Guidance under Sections 45, 45Y, 48, and 48E is available here: https://www.irs.gov/pub/irs-drop/n-23-38.pdf

[5] The IRS retains the discretion to reallocate capacity limits in the event that one category is oversubscribed and another has excess capacity. See Department of Treasury Additional Guidance on Low-Income Communities Bonus Credit Program, available at: https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3A1a431951-6e9d-363f-ae56-60c2123fb4eb

[6] We will examine the qualification criteria for low-income in a future article.